Why invest in Dubai is the first thought that crosses one’s mind before purchasing a property in Dubai, whether for personal use or as an investment. Simply put, Dubai is an economical place to buy quality real estate because its property prices per square foot are cheaper than those of many other cities worldwide.

According to the World Population Review, Dubai is one of the cities with the greatest population growth rates in the world, with a multiethnic population growing at a rate of 10.7% per year. But there are several things to think about to prevent any unforeseen errors before moving on, whether for personal use or merely for investment!

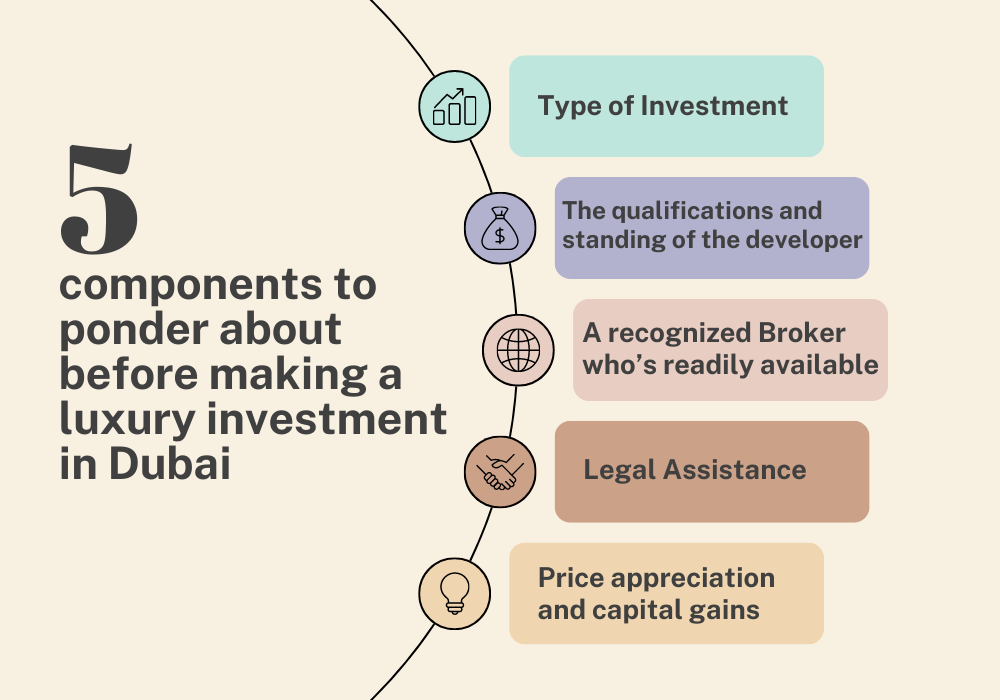

1- Type of Investment:

Dubai is home to two types of Investments: Freehold and leasehold properties. With a leasehold property, the buyer only has access to the villa’s usufruct rights, not the land itself for a term of 99 years or less, renewable at the end of the initial term. Compared to freehold ownership, leasehold offers more options for pricing and location in particular. The main drawback of such an investment is that any renovations or repairs to the property require the freeholder’s approval. Subletting is not allowed either.

On the other hand, international investors who are at least 21 years old are permitted to own real estate in Dubai on a freehold basis since 2002. Freehold ownership is nevertheless accessible in Dubai’s environs designated special areas. The property is entirely owned by the freeholders. Additionally, they are permitted to sell, lease, and rent the bought property. Another benefit is that a freehold property automatically passes to the family whether or not a will is present. The purchase of freehold real estate is also permitted by foreign nationals who reside outside the UAE.

The first things that draw Investors to make a strategic investment in Dubai are location and neighborhood. Even though freehold homes are frequently found in expensive neighborhoods, it is still advisable to take your time when choosing the ideal one for your needs as a resident or your financial goals as an investor. Selecting the right location is crucial as it may have an impact on the ROI you might anticipate from it in a few years.

2- The qualifications and standing of the developer:

You intend to invest in a luxury residential property in Dubai that is up for sale. You must first investigate the reputation of the developer. A trustworthy developer needs to be registered with the appropriate regulatory body, that is the Dubai RERA. When purchasing from a developer who has a track record of reliability, especially when it comes to ongoing projects, it is always safer and recommended. Going out in the field to conduct research is very helpful in addition to conducting an extensive online search on the builder. Customers who have purchased flats in past complexes as well as brokers can be of great assistance in this regard. It is important to verify the contractor’s qualifications prior making any investment. Keep in mind that a lack of transparency is a sufficient excuse not to invest.

3- A recognized Broker who’s readily available:

If you plan on making and investment through a Broker, keep in mind that the Broker should ensure complete and utmost transparency while advising you on any kind of investment. The Broker should also have complete knowledge about the local market trends and comprehensive idea of the neighborhood you plan on investing in, so that they can help you in making a strategic investment. Apart from advising you on which property to invest in, the Broker should also provide various other services like Property management, Loan Assistance and conducting due-diligence of the property so that you as an Investor can be rest assured that you are making a safe investment. The Broker should also help you in finding a tenant if you are making a rental investment.

4- Legal Assistance:

Like the purchase of any property anywhere, in order to invest in or purchase a property in Dubai, you must submit some legal paperwork and pay certain costs. Before purchasing a freehold property, you must complete the following 4 legally required steps:

• Pre-sale agreement: Before signing the final sales contract, this arrangement with the seller must first be made. It enables you to bargain, set the terms of the sale, decide on the payment options, etc.

• Memorandum of Understanding: Following your and the seller’s agreement on the terms of the contract, you must sign the MOU, also known as the sale contract or Form F, which you can download from the Dubai Land Department website and have both parties sign in front of a witness at the Registration Trustee office.

• No Objection Certificate (NOC): To transfer ownership, you have to apply for a NOC, which is often given by the developer in exchange for payment, only after verifying that there are no unpaid service fees related to the property.

• Property transfer: In order for the property transfer to go through, you must submit the following paperwork to the Dubai Land Department:

The originals of the buyer’s and seller’s identifying documents (such as their IDs, passports, and visas) as well as the NOC and signed contract are required. With regards to the costs incurred, please contact our team at White Tiger Realty and we would love to have you at our corporate headquarters for a cup of coffee and apprise you with the entire process in a seamless and smooth manner. Our team is well equipped to cater to all your needs in a comprehensive manner.

5. Price appreciation and capital gains:

Properties are now considerably more economical, thanks to Dubai’s burgeoning real estate market, and returns on investment currently outpace those of European global capitals. Additionally, a decrease of 5-8% is anticipated this year. As a result, the biggest advantage of real estate investments is price growth. Due to the significant economic gains and other advantages, including citizenship for foreign investors and more benevolent visa regulations, many people purchase second homes as investments.